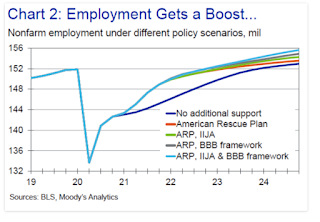

The reconciliation package is much larger and thus meaningfully lifts economic growth and jobs and lowers unemployment. The boost to growth occurs quickly, with real GDP increasing 4.9% in 2022, a percentage [point] more than if only the ARP is passed into law. The tax cuts for lower-income individuals in the package are mostly spent quickly, while the tax increases on corporations and high-income and wealthier households have a much smaller and slower impact on investment and consumer spending. The increased social investments in the package, particularly related to child- and eldercare, healthcare and housing, also quickly support stronger GDP and jobs. There are 1.6 million more jobs by mid-decade at the peak of the boost to employment, and the unemployment rate is 0.75 percentage point lower. The unemployment rate returns to its pre-pandemic lows in the mid-threes, although labor force participation never fully recovers given longer-term fallout from the pandemic. Longer term, the economy’s growth enjoys a measurable increase due to stronger productivity growth given greater educational attainment and higher labor force participation.A better economy and a higher-skilled, less desperate work force? No wonder why Republicans don't want BBB to pass. Chinn also includes a graph from Zandi which illustrates that there are nearly 4 million jobs have been added back in 2021 because of ARPA, and that some more will be added in the coming years because of the infrastructure bill. But of course, there's the concern about how to pay for Build Back Better. And Chinn notesthat Zandi goes over how much the deficit goes up in the first few years of Build Back Better (around 0,5% of GDP a year through 2026), and then that reverses and actually starts cutting the deficit as the tax increases stay, but some of the tax credits and spending fade out. But given the strong effects Build Back Better has on the economy, that seems to be worth it. Not only is it more growth, it is in a healthier manner that offers more support and assistance to more Americans than the inequitable, paper-based growth that we've seen in the 2010s and early 2020s. Seems like a good deal to me. The other thing that will keep things moving for the rest of 2021 and 2022 is vaccinating young kids and having adults get boosted, which can remove much of the overhang of COVID once and for all in the coming months.

Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Tuesday, November 9, 2021

2021 stimulus kept us from stalling out. And it can keep us rolling in 2022-23

With the passage of the "hard infrastructure" bill last week and Build Back Better still under discussion, I wanted to forward an article from UW's Menzie Chinn at Econbrowser. Chinn grabs from a couple of analyses to give you an idea what the stimulus measures of 2021 have added to the economy, and what would happen with further action.

First, let's start with an analysis by economist Mark Zandi that Chinn includes in his article. Zandi compares projections of what the economy would have done if there were no stimulus measures whatsoever in 2021, and then adds in the effects of the American Rescue Plan (ARP) from March, the IIJA (aka the roads/bridges bill passed last week), and Build Back Better (BBB).

As you can see, Zandi says that the American Rescue Plan alone has added between 4% and 5% of inflation-adjusted GDP in each of the first 3 quarters of 2021, and will nearly double economic growth in Q4. Then you add in the IIJA infrastructure bill, which doesn't add as much in 2022 (actually lowering economic growth in Q1 due to a short runup in prices and the tax pay-fors kicking in immediately), but starts paying off more in 2023 as the projects keep rolling. (click on picture if you wish to blow it up clearer)

Also notice how Zandi projects Build Back Better to add in even more growth, by 1-2% for each of the first 3 quarters of 2022 before settling back down. But Zandi also says it makes the economy more durable over the long run.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment