The Tax Policy Center recently released an analysis of who would benefit the most from the plans on Build Back Better regarding the SALT Cap, and says ends up being quite regressive.No SALT, no deal! I am confident it will be part of the final deal.

— Tom Suozzi (@RepTomSuozzi) October 28, 2021

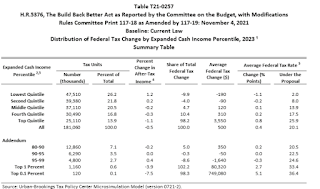

The plan TPC analyzed would boost the annual cap on the SALT deduction to $80,000 from 2021 through 2030 and restore the $10,000 cap for 2031. But because the cap would expire completely after 2025 under current law, very high-income households that pay large amounts of state and local tax would pay more in taxes with a $80,000 cap after 2025 than they would if the SALT cap completely disappeared. Despite what its promoters say, raising the cap to $80,000 would provide almost no benefit for middle-income households. It would reduce their 2021 taxes by an average of only $20. Even those making between $175,00 and $250,000 would get a tax cut of just over $400 or about 0.2 percent of after-tax income. By contrast, the higher SALT cap would boost after-tax incomes by 1.2 percent for those making between about $370,000 and $870,000 (the 95th to 99th percentile).That analysis has the SALT Cap going from $10,000 to $80,000, which is quite a difference and is even above the $72,500 that I've seen listed in the bill. Combine the higher SALT Cap of $80K with the other tax changes in the bill (including a continuance of the $3,600/year Child Tax Credit and higher taxes on incomes past $10 million, the Tax policy Center says most Americans would pay lower taxes under Build Back Better in 2022, but the middle and upper-middle classes would pay a bit more in 2023 as the larger Child Tax credit and EITC expansions are slated to end. But Build Back Better doesn't have to be that regressive due to the SALT Cap - or even being regressive at all. If the Cap is $72,500 or $80,000, then yeah, rich people will get a huge write-off and most of the benefit. But there are a lot of other ways to clean that up and not have it give away so much to those who don't need the help. It's worth noting that the SALT Cap is the same no matter if the filers are single people, or a married couple filing together. That penalizes dual-income married couples, unlike provisions that double up exemptions for married joint filers. One simple change would be to double the exemption for married hoint filers, to avoid that marriage penalty on two-earner families. The SALT Cap has also never been changed off of that $10,000 cap, despite 4 years of inflation. That's also unusual for tax provisions, most of which are indexed to price increases. By comparison, the standard exemption (which many former deducters are pushed into taking due to the SALT Cap) has been allowed to rise due to inflation, going from $12,000 single/$24,000 joint in the first year of the Tax Scam to $12,550 single/$25,100 joint when we file taxes this Winter, and $12,950/$25,900 in the year after that. If you only raise the SALT Cap to say, $15,000 for single filers and $30,000 for married joint filers, that limits how much the rich can write off, while still giving a benefit for a lot of two-earner married couples that own houses. Then the SALT Cap should be indexed for future years, to make sure no one loses their exemptions because of inflationary increases. There is also a question as to whether raising the SALT Cap gives you more bang for the buck than other types of tax credits and adjustments, Alyssa Flowers and Simon Ducroquet in the Washington Post gave their own SALT Cap analysis this week, and noted that the ending of Child Tax Credits in 2023 along with a very high SALT Cap could make for another disparity that benefits the rich more than working families.

The rich are poised to gain more from the SALT cap increase than lower-income people are from other elements of the bill, such as the child tax credit. According to the CRFB, a household in D.C. making $1 million a year would benefit 10 times as much from the SALT cap as a middle-class household would from extending the increased child tax credit for one year, which would provide an extra $1,600 for children under 6 and an extra $1,000 for older children. "We're debating about whether to give lower- and middle-class families a thousand dollars more a year through the child tax credit, while giving upper-class families $10,000 or more through SALT," said Marc Goldwein, senior policy director at the CRFB. "That's counter to everything the Democrats have been saying Build Back Better is about and everything they said about the Trump tax cuts."And that can definitely seem like a mixed message, except the SALT Cap was something that Dems railed against with the Trump tax cuts from the first time filers started getting screwed by it. In addition, most middle-class and upper-middle class parents would see benefits from both moves, if they have enough deductions to benefit from a higher SALT Cap. It would be even better for them if the Child Tax Credit was made permanent beyond 2022. So what needs to be figured out with the SALT Cap is that it needs to be high enough that it and other deductions like mortgage interest and charitable contributions don’t get surpassed by those figures, but low enough that it isn’t giving everything away to the rich. In the case of my wife and I, if we had a SALT Cap limit at $15K/$30K or even $10K/$20K, we wouldn’t hit either of those limits, but we would be able to write off (slightly) more than the standard deduction. But I'd argue the bigger benefit goes beyond the small amount of extra money we would have. It's having that tax write-off for our house and for our charitable contributions, and the change in incentives that results. That’s something Dems should emphasize. I think that’s a win-win, especially if you combine it with the surtax on $10 million and $25 million incomes, and use those funds to expand supports and services for those who are most in need of the assistance. We’ll find out soon enough just how the SALT Cap changes would affect how much money is available for Build Back Better, as the CBO says they will release their score of all of those provisions by the end of the week. There will have to be a lot of finessing in both the House and Senate to get this done, whether as a part of Build Back Better, or as a standalone in the 2022 Federal Budget, which also needs to be hashed out in the next 2 weeks. I think a modest raising and indexing of the SALT Cap would work out, and would target a specific type of traditional GOP voter that has been trending Dem in the 21st Century (upper-middle class homeowners). So if Dems want to hold onto Congress in November 2022, I’d recommend they get the SALT Cap figured out at the end of 2021.

No comments:

Post a Comment