Wanted to give a brief overview of last week's release of

The Budget and Economic Outlook from the Congressional Budget Office. The good news is that the budget deficit is going to drop this year to its lowest level since the COVID pandemic started more thn 2 years ago. And the reason why is because jobs and (nominal) incomes have continued to roar back, raising tax revenues.

According to CBO’s projections, under current law, the budget deficit in 2022 will be $1.0 trillion, $1.7 trillion less than the shortfall recorded last year, as spending in response to the pandemic wanes and revenues increase. That decrease would be larger if not for a shift in the timing of certain payments. Because October 1, 2022 (the first day of fiscal year 2023), falls on a weekend, certain payments that would ordinarily be made on that day will instead be made in fiscal year 2022. If not for that shift, this year’s projected shortfall would have been $68 billion smaller (see Table 1-2).

CBO projects that, under current law, revenues will increase by 19 percent in 2022, a slightly faster rate of growth than the 18 percent increase that occurred in 2021. That growth in 2022 results in part from the current economic expansion and the end of temporary provisions enacted in response to the pandemic that reduced revenues. However, even after accounting for those factors, tax collections so far in 2022 have been larger than currently available data on economic activity would suggest. CBO will evaluate the reasons for the discrepancy as more detailed information from tax returns becomes available. In total, revenues are projected to rise by $789 billion in 2022, to $4.8 trillion. Revenues will reach 19.6 percent of GDP this year—the largest that receipts have been as a share of the economy in more than two decades.

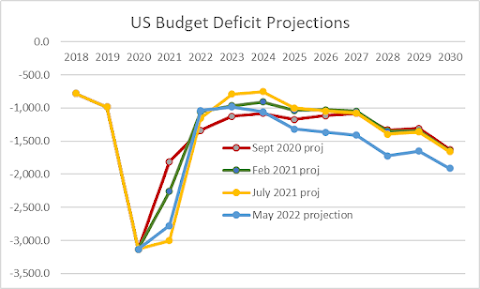

That's a smaller deficit for this year than CBO was projecting before the stimulus bills of December 2020 and March 2021 became law, and about $800 billion less than what CBO was thinking would happen last September.

The CBO adds that all of these stimulus measures will raise the deficit in isolation, but also is less than what was shelled out in 2020 and 2021. And the higher revenues due to strong economic growth over the last 2 years will more than counteract that increase in spending for this year.

Since CBO prepared its March 2020 budget projections (the final set of projections before most laws enacted in response to the pandemic took effect), legislation has increased the agency’s estimates of the federal budget deficit, excluding the costs of servicing the debt, by $0.5 trillion in 2022 and by $0.2 trillion in 2023, mostly by increasing federal spending. The effects of legislative changes on the deficit will be considerably smaller in 2022 and 2023 than in 2020 ($2.3 trillion) and 2021 ($2.6 trillion) because several provisions of pandemic-related legislation will expire or wind down (see Figure 2-2 on page 30). In CBO’s assessment, diminishing fiscal support in 2022 and 2023 will provide a smaller boost to the overall demand for goods and services than the significant boost provided by fiscal policy in 2020 and 2021.....

CBO revised its estimate of revenues in 2022 upward by $251 billion (or 6 percent) and its projection for the 2022–2031 period upward by $1.3 trillion (or 2 percent) for technical reasons. New tax data and stronger-than anticipated tax collections over the past year account for the most significant increases. CBO observes payments to the Treasury as they occur but does not receive detailed information on tax liabilities until as many as two years after payments have been made.....

Individual Income Taxes. Technical changes raised CBO’s estimate of individual income tax receipts in 2022 by $173 billion (or 7 percent) and its projections for the 2022–2031 period by $790 billion (or 3 percent). CBO boosted projected receipts at the beginning of the period because recent tax collections have continued to be stronger than expected given current economic data and the agency’s estimates of the budgetary effects of recently enacted legislation. Additionally, CBO revised upward its estimates of the amount of corporate business income taxed at the individual level throughout the projection period. That change reflects modeling

refinements based on recent historical tax and economic data. Partially offsetting the upward adjustments to 2022 revenues was a reduction in the anticipated amount

of payroll taxes that would be reallocated to individual income taxes in that year.

So that helps the budget in the short term, but the CBO also says that budgets are now slated to become notably larger in the coming years.

And a big reason why is an expense that had been falling over the last 2 years - interest on US debt. CBO says rates will rise ifor the rest of the year and continue to rise over the next couple of years, which means it will cost more to pay off the debt from future-year deficits.

In CBO’s projections, interest rates on short-term Treasury securities rise in concert with the increases in the target range for the federal funds rate

carried out by the Federal Reserve. In 2022 and 2023, the Federal Reserve rapidly increases the target range for the federal funds rate to reduce inflationary pressures in the economy. In CBO’s projections, the interest rate on 3-month Treasury bills follows a similar path, rising to 1.4 percent by the fourth quarter of 2022, 2.3 percent

by the fourth quarter of 2023, and 2.6 percent by the fourth quarter of 2024 (see Figure 2-4, bottom panel). The Federal Reserve reduces the target range for the federal funds rate in 2025 to counteract the drag on economic growth stemming from the higher individual income tax rates that take effect at the beginning of 2026 under current law. Accordingly, in CBO’s projections, the 3-month Treasury bill rate falls to 2.4 percent by the fourth quarter of 2026.

Interest rates on long-term Treasury securities are expected to increase through 2026, partly because short-term rates are expected to rise. Long-term interest rates are partially determined by investors’ expectations about the future path of short-term interest rates. Potential purchasers of long-term bonds weigh those bonds’ yields

against the yields from purchasing a series of shorter-term bonds (for example, purchasing a 1-year bond each year for 10 years). When the expected future path of short-term interest rates rises, the yield on long-term bonds rises to ensure that there are enough buyers for all the long-term bonds currently for sale. In CBO’s projections

(which reflect economic developments as of March 2, 2022), the interest rate on 10-year Treasury notes rises from 1.5 percent in the fourth quarter of 2021 to 2.7 percent in the fourth quarter of 2022 as the Federal Reserve tightens monetary policy, signaling a higher future path for short-term interest rates. After 2022, the interest rate

on 10-year Treasury notes rises more gradually, increasing to 2.9 percent in the fourth quarter of 2023 and 3.1 percent in the fourth quarter of 2024.

What's funny to me about this is that a typical Koched-up complaint about deficits is that they cause inflation by "overspending", which devalues the dollar. In fact, the dollar is at a 20-year high vs other currencies, and inflation stayed high (and went higher) after government stimulus went away and overall government spending started going

down several months ago.

Instead what we have is the Federal Reserve raising interest rates to head off inflation that has partly due to very strong economic growth, and partly due to supply constraints

and profiteering that has little to do with the spending of tax dollars. And the higher rates will result in higher costs to pay off the debt, which translates into much of the increase in spending over the next 10 years.

Overall federal spending has dropped in 2022 as fewer funds are needed for COVID treatment and relief, but other areas are going to rise - from infrastructure to defense to debt service to Social Security and Medicare.

In CBO’s projections, total federal outlays decrease by $1.0 trillion in 2022. (That amount excludes shifts in the timing of some outlays; the discussion of CBO’s projections that follows reflects adjustments to remove the effects of timing shifts.) The decline in 2022 is dominated by a $1.1 trillion drop in estimated mandatory spending—the result of sharply lower pandemic-related spending—to $3.7 trillion this year. That large decrease is partially offset by much smaller increases in discretionary outlays and net interest costs. Assuming no changes to current law, discretionary outlays are projected to increase by $81 billion (or 5 percent) and reach $1.7 trillion this year; the government’s net interest costs are projected to increase by $47 billion (or 13 percent), to $0.4 trillion.

What I also want to note is that the CBO says the economy should remain strong in the coming years, with full employment and/or employment shortages. It also means higher levels of nominal GDP and wages and salaries than what was anticipated last year, although some of this gets eaten up by inflation (especially in the next 2 years).

Sure, you can say that the higher deficits and interest costs for that debt could become a headwind, but that can be solved by simple fiscal means such as taxing the rich and/or raising the cap on earnings for Social Security and/or Medicare, or increase user fees for highways via gas tax and/or registrations. We also could certainly cut into our $750 billion military budget if we wish, and there are trillions in surpluses in other trust funds that are growing and will never be used (like disability and retirement funds of military and other federal employees) that can replace the deficits in other trust funds.

And I would much rather the Fed undershoot with lower interest rates and risk inflation than overshoot us into recession with higher rates and higher debt costs. I don't see other countries cutting us off or destroying our dollar any time soon, and I still hold a bias that we need to keep growing the economy as much as possible and/or keep the safety net robust when economic downturns happen.

I think it's better if people don't fall on hard times due to fiscal austerity, and while I get that rising deficits in future years are going to be something to stay aware of, the deficit shouldn't be the dominant reasoning behind why we make decisions on economic policy.

No comments:

Post a Comment