Despite all of the negative stories about "the economy",

we still had solid increases for income and spending in April.

Personal income increased $89.3 billion (0.4 percent) in April, according to estimates released today by the Bureau of Economic Analysis (tables 3 and 5). Disposable personal income (DPI) increased $48.3 billion (0.3 percent) and personal consumption expenditures (PCE) increased $152.3 billion (0.9 percent).

Real DPI increased less than 0.1 percent in April and Real PCE increased 0.7 percent; goods increased 1.0 percent and services increased 0.5 percent (tables 5 and 7). The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.3 percent (table 9).

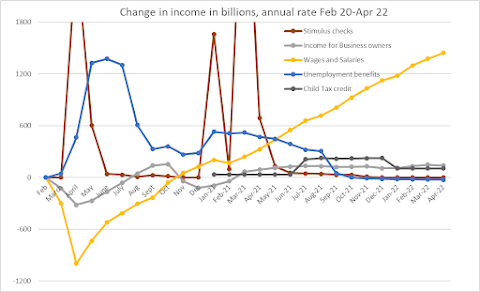

On the income side, while the increase of $66.8 billion in wages and salaries was the lowest since January, it still continued over a year of relatively steady increases in that category, replacing the loss of income from COVID-related stimulus measures.

What kept real disposable incomes from declining last month was a second straight month with sizable increases in dividend and interest income ($22.3 billion) – not something that many lower-income/wealth people would benefit from. Could be a pattern to keep an eye on.

In total, this is a pretty good report, and it’s notable that consumption expenditures grew well past the rate of inflation for April. We may keep hearing that

consumer sentiment is at its worst in a decade because of higher prices, but it’s not changing the spending habits of Americans, which means the economy keeps moving along.

Those numbers also indicate that despite the increase in Omicron cases throughout the country in April, that consumers continued to head more toward spending on services, especially with travel and “going out” types of activities.

The $152.3 billion increase in current-dollar PCE in April reflected an increase of $48.6 billion in spending for goods and a $103.7 billion increase in spending for services (table 3). Within goods, increases were widespread across all components except for gasoline and other energy goods; spending for motor vehicles and parts was the leading contributor to the increase. Within services, increases were also widespread across all components, led by food services and accommodations as well as housing and utilities.

Food services keeps rebounding from the depressed state it was in during the first year of the pandemic, as are accommodations. Although it is still behind the spending growth of some goods-oriented industries in the COVID era, these industries have seen quite a bit of a comeback since vaccines became widespread in early 2021, and its growth has beaten inflation for each of the last 3 months.

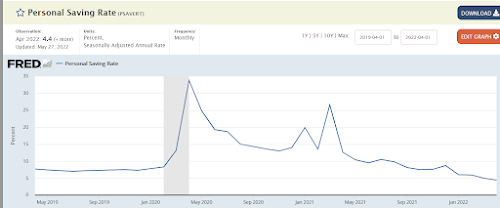

The red flag I see in this report is that we are at multi-year lows on personal saving, down to 4.4%.

I think that the stimulus-induced gains in income for 2020 and 2021 (and the double-digit savings rate associated with it) help to explain how this level of spending and lower savings can continue even as stimulus payments have dried up. But it’s worth wondering what happens when that cushion goes away, and also if higher interest rates starts to encourage higher savings (or discourage borrowing).

That could become a significant headwind on what seems to be a still-strong consumer sector later in 2022. But when you combine these good spending numbers with the lack of layoffs in the jobs market (still barely above 200,000 a week) and the large amount of travelers expected for this holiday weekend, it sure seems like this economy continues to grow as we near the halfway point of this year.

I know gas prices have gone up since April and that we won’t see 2021’s level of 5.5% GDP growth. But it still looks like we are still recovering and expanding, no matter what Wall Streeters and Republicans try to tell you. Only when spending habits, saving habits and/or the rate of price hikes change will I think that things are any different than what we've seen for most of 2022 - higher inflation, but continued growth. And that beats recession.

No comments:

Post a Comment