We figured growth in US real GDP would slow down from the torrid pace of 5.7% growth for 2021 and 6.9% for Q4. But I don’t think many were expecting

the number we saw Thursday morning. The U.S. economy unexpectedly contracted in the first quarter amid a resurgence in COVID-19 cases and drop in pandemic relief money from the government, but the decline in output is misleading as domestic demand remained strong.

Confused? Less output, but more demand and a lot more jobs in the first three months of 2022? So what’s the disconnect?

A lot of it is due to the fact that a lot more of the products that were being bought were made outside of the US.

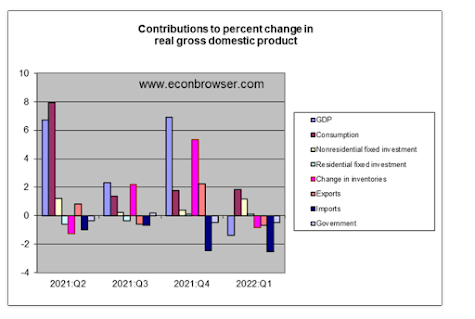

Front-loading by businesses fearful of shortages because of the Russia-Ukraine war contributed to a surge in imports. Exports tumbled, leading to a sharp widening of the trade deficit, which chopped 3.20 percentage points from GDP growth, the most since the third quarter of 2020. Trade has now been a drag on growth for seven straight quarters.

Businesses have turned to imports to satisfy demand, with local manufacturers lacking the capacity to boost production. Business inventories increased at a $158.7 billion pace, slowing from the robust $193.2 billion rate in the October-December quarter. Inventory investment cut 0.84 percentage point from GDP growth.

Remember, this is Gross DOMESTIC Product, so while a foreign-made product is still economic activity that keeps money flowing through America, it doesn’t add much to GDP.

Dig into

the full figures from the Bureau of Economic Anlysis, and you’ll find that consumer spending added more to the economy than it did in either of the last 2 quarters of 2021, even after adjusting for the increase in inflation.

Take out the trade-related stats and the decline in inventories, and there really isn't much difference in the amount of economic growth between the first 3 months of 2022, and the blowout growth number we had to end 2021.

Rex Nutting is the Washington Bureau Chief for CBS Marketwatch, and he saw a bigger warning sign in the GDP report,

which makes him think the strong pace of consumer spending is likely to slow down.

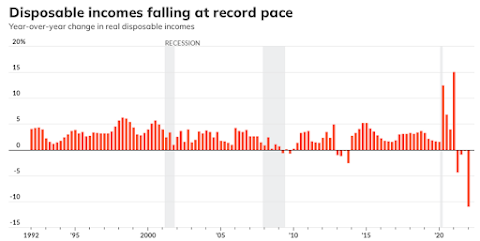

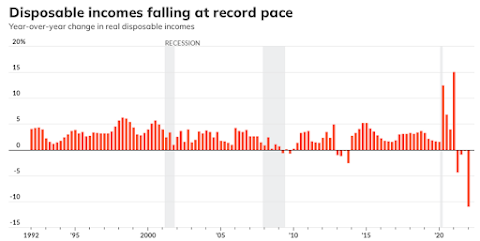

Nutting says that is because COVID-era relief programs have faded away, giving less money going to Americans from DC. While that development should control inflation, Nutting says it wuld also would be a serious headwind on economic activity as 2022 progresses.

Over the last four quarters, the purchasing power of after-tax household incomes plunged by $2.2 trillion (in 2021 dollars). That’s a 10.9% decline, by far the largest in the records dating back to 1947.

Of course, the decline in incomes is merely the unwinding of the massive support that households received from the government in 2020 and 2021 via direct pandemic stimulus payments, the child tax credit, and enhanced benefits for unemployment insurance, food stamps and Medicaid, and more.

This means that the Fed is chasing a shadow. Because if our current spike in inflation is all due (as many people argue) to an overly generous federal government giving its people too much money, then our inflation problem is about to go away.

As economists Yeva Nersisyan and L. Randall Wray of the nonpartisan Levy Economics Institute of Bard College conclude in a paper published this month ahead of the GDP report: “Most of the government’s income support has already disappeared, so going forward it is not an important contributor to demand in the economy.”

The faucet has been turned off. Without all the extra money from Uncle Sam, U.S. households will have to live within their means once again. Demand will slow, and so too will inflation, according to the ironclad economic laws of supply and demand.

Nutting ads that this economic slowdown could be turned into a full-blown recession if the Fed continues to think that it has to be the ones actively trying to control inflation, and raises interest rates too much in the coming months in a time when demand and prices would already be leveling off.

I agree that recession is the bigger threat to our economy than the inflation we're seeing - although some actions to slow down the greed in corporate America would help get prices back toward balance (higher taxes on the rich and corporate, strong anti-trust enforcement, making more things in the US, you name it).

Unemployment claims remain at 50+ year lows, and if anything, there aren't enough workers around to handle the country's hot demand, so I don't see a major threat of job loss UNLESS we see a quick rise in interest rates that leads to a crash in the housing and asset markets.

I'm not saying things are as great with the economy as it looked like a few months ago. But I am saying that things are still in a good place, and despite what a decline in GDP might tell you, we aren't near any kind of recession that cuts jobs.

But adjustments are ongoing, and more are likely to come. What those adjustments to an inflationary, post-COVID World are is going to be the big story in the economy for the 6+ months until the November elections.

No comments:

Post a Comment