With Wisconsin on track to have nearly $4 billion in the bank in its General Fund by the end of June 2023, it would seem to be a good time for these extra funds to be put to use and repair a lot of the underfunding that happened throughout the 2000s and (especially) the 2010s.

But

Dale Knapp at Forward Analytics (doing work for the Wisconsin Counties Association) says the state needs to continue to add to its Rainy Day Fund instead of using the General Fund’s surplus. Which seems to be an odd comment because Wisconsin’s Rainy Day Fund is at an all-time high, and by law literally

cannot be added to today.

But

the Counties Association report says that General Funds dollars can dwindle quickly, and that the state’s Rainy Day reserves are still below national standards.

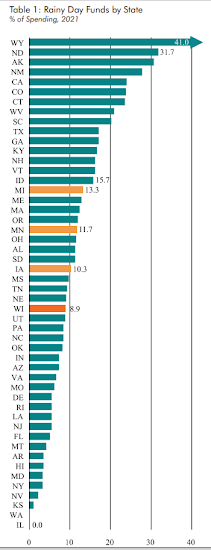

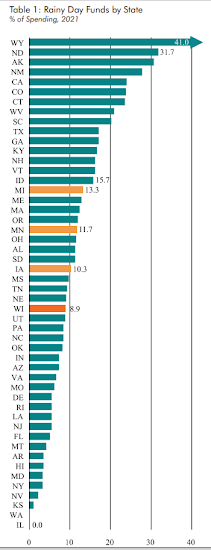

If the general fund balance is unreliable as a long-term cushion against recession, then the state might consider bolstering its budget stabilization fund, which is designed specifically for that purpose. Currently, the $1.7 billion in that fund is 8.4% of spending, above the 5% target in state law. However, most budget experts argue that a 5% target is too low. The Government Finance Officers Association recommends holding at least 16% of spending in reserve….

Although not currently on the radar, a prudent use of some of the general fund balance would be to bolster the budget stabilization fund to an amount at or near the GFOA recommendation. This would ensure the state is well prepared for the next recession as state law restricts the use these dollars. And, it would still leave a general fund balance between $1.3 and $2.6 billion to use for other priorities.

The study said looked back at the Great Recession, and pointed out that economic downturn led to billions of dollars in declines in revenue in Wisconsin, which means the current Rainy Day Fund of $1.7 billion might not be sufficient to handle things if such a recession happened again.

In 2009, tax collections were $1.5 billion less than the amount budgeted. That $1.5 billion was 11% of budgeted 2009 spending. The recession’s impact on tax revenues continued in subsequent years. Collections in 2010 and 2011 combined were an estimated $4.0 billion less than they would have been had the recession not occurred. In fact, it took four years for tax revenues to return to 2008 levels.

While true, I’d argue that more robust supports for both individuals and government services would go a long way toward preventing such a decline in revenues and activity in the next downturn. We’ve seen with the COVID-era relief programs that giving supports in tough economic times keeps people afloat, and makes it more likely that the economy can be restored to full capacity in a quicker time than we saw with the slow (albeit steady) growth that happened in the wake of the Great Recession.

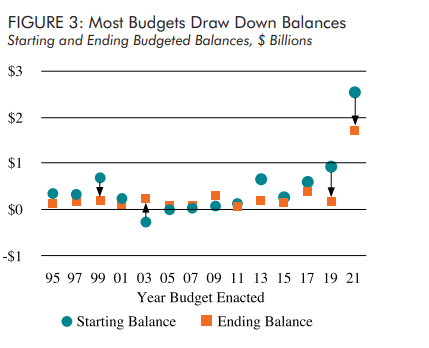

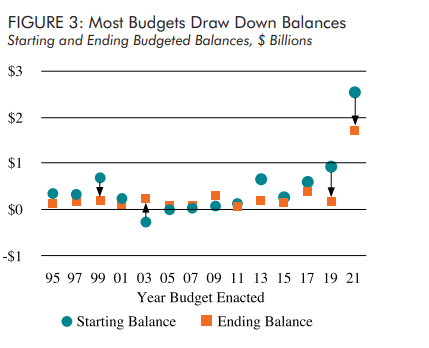

Part of the concern that Knapp and the Counties Association has is that the state’s budgets are often set up to spend more than they take in when they are signed into law. Knapp’s group says this means the budget is out of balance, and in danger of getting worse should the economy bog down.

But I'll also point out the flip side of this chart, as you can see with the blue circles have risen in each budget since 2015, meaning that Wisconsin finances have exceeded expectations in each of the last 3 biennia (and is well on track for a 4th in the 21-23 budget).

The Forward Analytics Report says this is budgeting dangerously, with a "structural deficit" set up over the course of those two years, so let’s see how the Counties Association recommends how state lawmakers can add on to the currently maxed Rainy Day Fund.

Two actions would immediately strengthen Wisconsin’s ability to withstand the next recession. First, increase the state’s budget stabilization target from 5% of spending to 15% or more of spending. This would not make Wisconsin an outlier in terms of a relatively high rainy day fund target. Rather, Wisconsin would join 21 other states with targets at least that high or with no restrictions on rainy day fund deposits.

Second, the state now has a sufficiently large general fund balance that it could shift at least $1.25 billion of those dollars to the budget stabilization fund. Wisconsin would join 15 other states as the most prepared with rainy day fund balances of at least 15% of spending (see Table 1 on page 10).

A third action would help ensure a sufficient balance once the budget stabilization fund is used during a recession. In the 36-year history of the fund, lawmakers have never voluntarily appropriated dollars to the stabilization fund. Transfers have only come via the state law on shifting excess tax collections. Lawmakers might consider some level of mandatory annual appropriations to the fund until it again reaches 15% of spending or whatever target is chosen for the fund.

I get the point if you’re talking about the straight numbers, and you certainly don’t want to be Illinois and constantly borrowing and doing accounting tricks to pay the bills. I do think that makes sense to allow the Rainy Day Fund to be added onto, perhaps with one-time deposits that gain interest in a time of rising rates.

But I also don’t see where sitting on all of our $3.8 billion surplus helps this state’s ability to attract and retain workers and families, and that’s what needed in a time of workforce shortages and aging demographics. While we can talk about one-time deposits into the Rainy Day Fund, I think it would be more useful in 2022 to give a one-time tax rebate to Wisconsinites to help them pay bills.

Evers wanted to do such a one-time rebate

that would have given $150 for every Wisconsinite ($600 for a family of four, as an example), and while the idea is gimmicky, it also went along with Knapp’s recommendation that spending increases not be ongoing. And at a price tag of $816 million, there would still be another $3 billion that could be used as a fiscal cushion, Rainy Day Fund, or other needs.

Naturally, the Republicans in the gerrymandered Legislature didn’t want to do anything that might help Evers (and by proxy, Wisconsinites) before the November election. But if this state is stupid enough to vote in a GOP Governor and keep GOPs in charge of the Legislature, you can bet they will blow those billions as fast as they can. That’s what they did in 2014, with wide-ranging tax cuts given out after a one-time bump in revenues, which

resulted in a sizable budget deficit that magically appeared after that November’s election, in a time that had a much smaller Rainy Day Fund.

That deficit was “solved” by Scott Walker cutting $250 million from the UW System without allowing the universities to make up the difference with tuition or other means, among other idiocies. And those cuts have yet to be restored, so perhaps getting that generator of talent back up to speed is a bigger priority for 2022 and 2023 with the huge amount of funds that we have, along with reforming an outdated school/local government funding system that is too reliant on property taxes.

I appreciate Dale Knapp and the Forward Analytics team breaking down the numbers and reminding us how quickly extra funds can go away if the economy goes wrong. And having artificial caps on the state’s Rainy Day Fund is likely an outdated concept that should be changed, as it can’t hurt to allow some more money go into it as finances stay strong in 2021-22.

But at a certain point, you’re impeding your own economy by having green eyeshades, and with billions available, it makes no sense for the state not to take advantage and improve the quality of life, stability and pocketbooks of its residents. So while the advice to keep the budget “structurally balanced” works on a balance sheet, it doesn’t make it the best idea in these times.

No comments:

Post a Comment