Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Sunday, July 3, 2022

Gas went up, Americans drove less, and supply is adequate. Prices should fall more

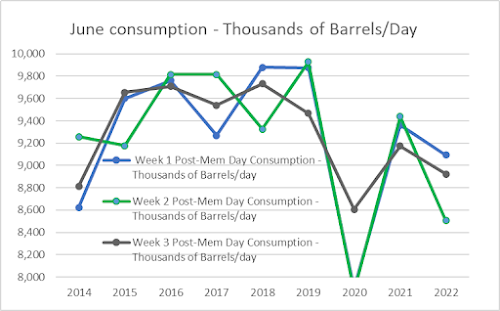

After some technical glitches, the US Energy Information Administration (EIA) recently updated its numbers on gasoline usage and supply for most of June. And it shows that after Memorial Day, Americans responded to higher gas prices by using less gasoline than they have in most recent years (outside of the shutdowns of 2020).

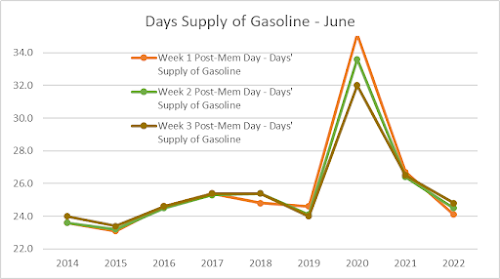

And while US gasoline supplies are tighter than they were in the last 2 years, it's not very different than what we had 3 years ago, and it's more than what was available 6-8 years ago.

But gas prices sure weren't this high 6-8 years ago (although we do forget that gas was well over $3.50 a gallon back in 2014).

I know it's a world price for products and I know gas prices are significantly higher in other parts of the world than here. But prices still are not reflecting the supply-and-demand situation that exists for gasoline in the US today. And while prices at the pump have fallen for 3 straight weeks, and should be reflected in softening inflation figures for July, it's still a lot more than we were dealing with a few months ago.

Which means that we should take a very close look at the profits of oil companies when they announce their Q2 earnings over the next month or so. In theory, they shouldn't be building on the billions in profits and share buybacks that they have had earlier in 2022. If they are, it's time to crack down on them and the speculators that have driven up these prices and inflicted economic stress onto so many Americans.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment