Oh, noooooo! Two straight quarters of declining (real) GDP growth, that must mean the economy is in recession. All the books tell me so, and I'm sure the pros agree.BREAKING: The U.S. economy shrank for a second straight quarter, contracting at a 0.9% annual pace and raising fears that the nation may be approaching a recession. https://t.co/dYUTWSjd80

— The Associated Press (@AP) July 28, 2022

As proof of that, the US gained 1.1 million jobs in the Q2 that allegedly had negative growth. And while jobless claims are off their 50-year lows, they are still barely above 250,000 new claims a week - well below the 350,000-400,000 a week that has presaged recessions over the last 40 years. So what's a good paralell to our current situation? I think this explains it well.JUST IN: Fed Chair Powell says the US is NOT in a recession

— Heather Long (@byHeatherLong) July 27, 2022

"I do not think the US is currently in a recession," he says. "The reason is there are too many areas of the economy that are performing too well."

(He points to a "very strong" labor market) pic.twitter.com/aGmmZoTrkE

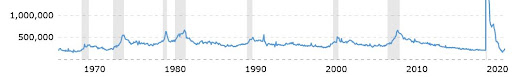

The Two Quarter GDP Decline of 1947 https://t.co/oPy55CTv94 pic.twitter.com/FU5CusXjzb

— Menzie Chinn (@menzie_chinn) July 26, 2022

And what happened back then? A transition from a prior wartime economy to a post-war economy, and one that had almost over-full employment with a gap in the amount of available workers and supplies to keep up with the high demand. This needed some sorting out, but was also a very strong time for the economy overall. Feels pretty similar today, doesn't it? That high 7%+ nominal GDP doesn't seem as likely to go down as much as inflation seems likely to do, given how gas and home prices are correcting. I was also grabbed by the reality that consumer spending still topped the level of inflation for Q2 2022 - +1.0% real increase, and +4.1% for services. Consumers adjusted their habits to the higher prices of goods by not getting as much food at home and gasoline, but still spent more in other areas. And reports from this week show higher levels of new manufacturing orders and higher inventories for June, along with a declining trade deficit for goods. That's the direct opposite of a "high-inflation + recession" scenario. So my thoughts? If this is a recession, it's the oddest, least-painful one I can recall. One with job growth, consumer adjustements and shortages instead of a need to cut back on the business side. We'll see if things start to level out in July and for the rest of Q3.We've been talking to clients a lot recently about how the current period mirrors 1945-1950. Supply chain issues, huge change and surge in consumption. Big inflationary spike the Fed had to tamp down. Real GDP shrinkage with strong nominal GDP growth.https://t.co/SwynkmoDNf

— Rob Spivey (@spiveyvalens) July 28, 2022

No comments:

Post a Comment