After a weak retail sales report for May, yesterday’s release was going to give an indication as to whether consumer spending wasn’t keeping up with inflation in June. And the answer is….

an improvement, but still a bit lacking. Consumer spending held up during June’s inflation surge, with retail sales rising slightly more than expected for the month amid rising prices across most categories, the Commerce Department reported Friday.

Advance retail sales increased 1% for the month, better than the Dow Jones estimate of a 0.9% rise. That marked a big jump from the 0.1% decline in May, a number that was revised higher from the initial report of a 0.3% drop.

Unlike many other government numbers, the retail figures are not adjusted for inflation, which rose 1.3% during the month, indicating that real sales were slightly negative.

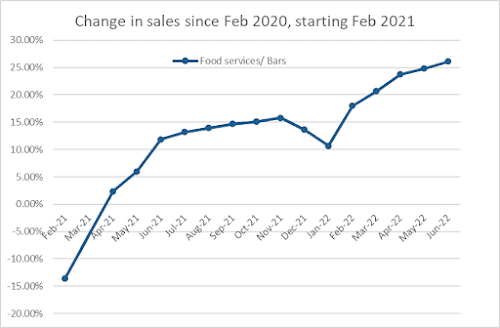

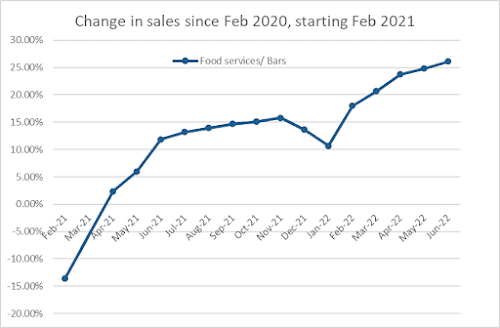

It’s worth pointing out that even with prices going up, the dollar increases in retail sales have calmed down after a significant increase in early 2021 after people were able to be vaccinated and COVID-related constraints were relaxed (and another jump in early 2022, as travel bounced back).

This indicates that the post-COVID and stimulus-fueled bump that happened for consumer spending has now faded, and policymakers should expect us to be back in a more neutral situation (albeit with higher prices and nominal wage growth than the pre-COVID era).

A little over 1/3 of June's (dollar) increase in retail sales happened at gas stations, but it’s worth noting that the 3.6% increase in gasoline sales vs May was much less than June’s 11.2% increase in gasoline prices that was central in the

Consumer Price Index report released earlier this week.

Along the same theme - grocery stores had a 0.6% increase in retail sales for June, while prices for “food at home” were up 1.0% last month. So does that indicate Americans are buying less food at the grocery store, or are we seeing something that the Chicago Fed noticed in this week's

Beige Book Report. ...One contact noted that when higher costs were passed through to consumers, lower income shoppers were trading down and buying more in-store brands, while higher income shoppers were buying more goods in bulk.

So are people not necessarily cutting back,but instead are "downscaling" and lowering their per-unit costs? That’s an important question to answer, because it’ll affect different products and businesses in very different ways.

Interestingly, retail sales outside of gas stations were up 0.7%, and June’s increase in CPI outside of energy was…0.7%. Bars and restaurants had a 1.0% increase in retail sales, and the CPI increase for “food away from home” was….0.9%.

In fact, bars and restaurants have been a consistent standout in these retail sales reports for more than a year, indicating that the higher prices for gasoline and food aren’t keeping people from going out for those types of "fun" activites.

To further this point, the increase in retail sales over the last 12 months is at 8.4% - which is a good nominal number. But it is also not as much as the 9.1% increase in inflation over the same time period. I’d say it’s not as much of a consumer recession going on as much as it is people not needing as much of the things that they already acquired earlier in the more-homebound parts of the COVID era, and being pickier about what they want to get today.

To me, the retail sales report is an indication that we can get the "soft landing" where demand levels off enough to allow supply and labor shortages to catch up, but that we don't have to deal with significant job loss and other horrible things that would come with a serious recession. And with gasoline now down below $4 here in Wisconsin (just saw $3.85 today), does the Fed need to continue with a series of big rate hikes to break inflation when prices already seem to be on the way down?

No comments:

Post a Comment