Total inventories of merchant wholesalers, except manufacturers’ sales branches and offices, after adjustment for seasonal variations and trading day differences, but not for price changes, were $878.6 billion at the end of May, up 1.8 percent (±0.2 percent) from the revised April level. Total inventories were up 24.7 percent (±1.2 percent) from the revised May 2021 level. The April 2022 to May 2022 percent change was revised from the advance estimate of up 2.0 percent (±0.2 percent) to up 1.8 percent (±0.2 percent)…. The May inventories/sales ratio for merchant wholesalers, except manufacturers’ sales branches and offices, based on seasonally adjusted data, was 1.26. The May 2021 ratio was 1.22.That followed a 2.3% increase in the value of wholesale inventories in April, and products such as furniture, electricals, hardware, machinery and clothes have had inventories grow faster than that. We should be seeing lower prices start to show in those areas as soon as this week’s June CPI report, and certainly in future months. I look at things like this, and I am starting to get more optimistic about the chances that inflation can moderate in the 2nd half of 2022 while not slamming the economy into a sudden recession, which is precisely the “soft landing” scenario that the Federal Reserve and others would like to see. Of course, that would include the Fed not overreacting to past inflation by raising rates so high that it causes severe (and unnecessary) damage to some sectors of the economy, and that part I’m not as sure of.

Ventings from a guy with an unhealthy interest in budgets, policy, the dismal science, life in the Upper Midwest, and brilliant beverages.

Monday, July 11, 2022

Recent gas, inventory trends should calm inflation

After the 4th of July, we finally started to see gasoline prices fall back to a level that was more in line with the actual supply-and-demand levels throughout the country. This is what I paid on Saturday here in Madison.

And if you look at the latest consumption data from the Energy Information Administration, Americans were using less gasoline in the week before the 4th of July in 2022 than they were in pre-COVID times, continuing a trend that we have seen in recent months since gas spiked higher following Russia's invasion of Ukraine.

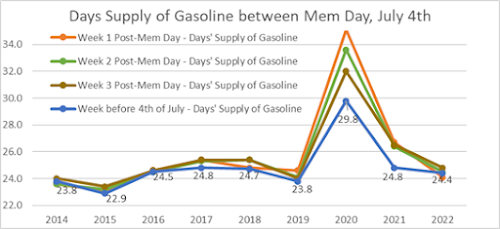

And as I’ve noted before, gasoline supplies weren’t any tighter than they were in most pre-COVID years, and even wasn’t much different than it was last year. I've added the labels to reflect the figures for the week before the 4th of July for the last 9 years.

(I’ll note that pre-4th of July week of 2021 had record travel, as people were able to finally have a full Summer holiday weekend post-vaccination. Because we figured the COVID era was over, right?).

We’re also seeing evidence that inventories are rebounding in manufacturing and other wholesale sectors, which should relieve price pressures in those areas.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment