Know how I've said that the runup in oil and gasoline prices seems like BS and speculation?

Today sure adds a lot of evidence to that theory. For the first time in nearly two months, crude oil prices have fallen below $100 a barrel, reflecting investors' growing concerns about a US recession that could crimp demand for oil.

The price of West Texas Intermediate crude tumbled as much as 10% Tuesday, to hit a low of $97.43 before closing at $99.50, down 8% on the day. Brent crude oil was down by more than 10% when it hit a low for the day of $101.10 a barrel, before settling at $102.77 at the close.

It's the first time that WTI has been below $100 since May 11. That was also the last time Brent, which typically trades a bit higher, was below $102 a barrel. Brent has not been below $100 since April 25.

Wholesale gas futures fell as well, down almost 10% for the day at the close, or 36 cents a gallon.

These are futures prices, so we won't see a 36 cent drop at the pump right away. But as I mentioned a couple of days ago, gas and oil supplies weren't that tight in America to begin with, and Americans had already adjusted to the higher prices by cutting back on their driving.

Or maybe they're picking their spots better, as travel on the Memorial Day and

4th of July holiday was up, with air travel hitting records for this time of the year.

Airlines sure aren't in recession -

fares are up 25%, and the biggest problem in the industry today is

large numbers of flight cancellations because airlines lack the crew and planes to keep up with the demand.

And after last week's run of weak data,

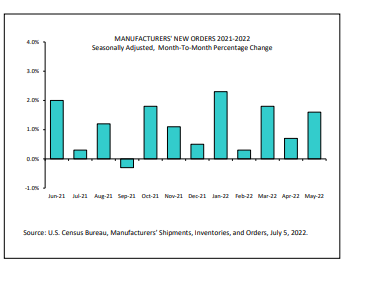

this news was a welcome sight. New orders for manufactured goods in May, up twelve of the last thirteen months, increased $8.4 billion or 1.6 percent to $543.4 billion, the U.S. Census Bureau reported today. This followed a 0.7 percent April increase. Shipments, up twenty-four of the last twenty-five months, increased $9.9 billion or 1.8 percent to $544.4 billion. This followed a 0.6 percent April increase. Unfilled orders, up twenty-one consecutive months, increased $3.9 billion or 0.4 percent to $1,110.0 billion. This followed a 0.5 percent April increase. The unfilled orders-to-shipments ratio was 5.98, down from 6.05 in April. Inventories, up twenty-one of the last twenty-two months, increased $10.0 billion or 1.3 percent to $797.9 billion. This followed a 0.8 percent April increase. The inventories-to-shipments ratio was 1.47, unchanged from April.

Even if you figure inflation of 0.7%-1.0% a month, the dollar amount of manufactured goods being ordered has been consistently outpacing that.

Even if we get a softening of orders in the coming months, there are plenty of prior months' demand to get caught up on. Which is yet another reason that I'm not too concerned with Wall Street's moaning about "recession".

But if the fears from speculators cause prices at the gas pump to fall back to reality, and it gets people feeling better about an economy that isn't nearly as bad as they're being told? I guess I'll take that.

No comments:

Post a Comment