In the latter half of the week, we got a couple of economic reports that gave worrying signs about what might happen to the economy in the second half of 2022. The first was on Thursday, and

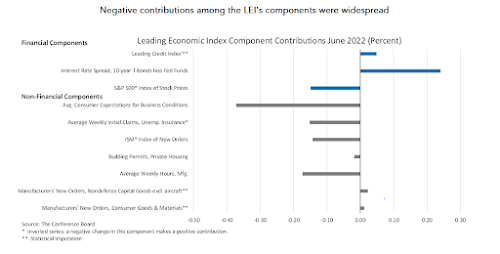

showed a second straight drop in leading economic indicators go down. The Conference Board Leading Economic Index® (LEI) for the U.S. decreased by 0.8 percent in June 2022 to 117.1 (2016=100), after declining by 0.6 percent in May. The LEI was down by 1.8 percent over the first half of 2022, a reversal from its 3.3 percent growth over the second half of 2021.

"The US LEI declined for a fourth consecutive month suggesting economic growth is likely to slow further in the near-term as recession risks grow,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. “Consumer pessimism about future business conditions, moderating labor market conditions, falling stock prices, and weaker manufacturing new orders drove the LEI’s decline in June. The coincident economic index which rose in June suggests the economy grew through the second quarter. However, the forward-looking LEI points to a US economic downturn ahead.”

“Amid high inflation and rapidly tightening monetary policy, The Conference Board expects economic growth will continue to cool throughout 2022. A US recession around the end of this year and early next is now likely. Accordingly, we’ve downgraded our forecast of 2022 annual Real GDP growth to 1.7 percent year-over-year (from 2.3 percent), while 2023 growth was downgraded to 0.5 percent YOY (from 1.8 percent).”

In looking at what caused the Leading Index to decline, a lot of it had to do with the Confidence Fairy – which was at a low point in June as consumers were especially grumpy with gas prices and inflation reaching their peaks.

.

So that decline in consumer expectations may not be as bad when the July report comes out, and

the S&P 500 stock index has bounced back by about 5% so far this month (hope I didn’t jinx that).

On the flip side,

the yield on the 10-year note has fallen in recent weeks, and the Fed Funds rate is likely to be 75 or 100 points higher after next week’s meeting. That will put a significant cut into the Leading Index, so I’ll call it a draw until more July reports come in.

However, the same report did not indicate the current economy had actually fallen into recession last month, and instead was merely slowing down.

The Conference Board Coincident Economic Index® (CEI) for the U.S. increased by 0.2 percent in June 2022 to 108.6 (2016=100), after increasing by 0.2 percent in May. The CEI rose by 1.2 percent in the first half of 2022, the same rate of growth as in the second half of 2021.

But then we saw

the Purchasing Managers’ Index (PMI) report on Friday indicating that perhaps things already

were in decline.

US private sector firms indicated the first contraction in business activity since June 2020 in July, according to latest ‘flash’ PMI™ data from S&P Global. The downturn in output signalled a further loss of momentum across the economy of a degree not seen outside of COVID-19 lockdowns since 2009. The downturn was led by a steep drop in service sector activity, though production at manufacturers also fell marginally, down for the first time in over two years.

YIKES! What caused that? Let's start on the services side.

Following a slight contraction in June, new business returned to expansion. The marginal upturn in client demand was much softer than that seen in the last two years, however. Inflation and weak demand conditions reportedly continued to weigh on new sales. At the same time, new export business decreased for the second successive month amid challenging economic conditions in key export destinations.

Manufacturers were also reporting weak future demand in this report.

Driving the decrease in the headline index reading were broadly unchanged production levels and a further fall in new order inflows. The seasonally adjusted Output Index dropped below the 50.0 no-change mark for the first time since June 2020, as total new sales and new export orders fell at the sharpest rates since the initial stages of the pandemic over two years ago.

But along with that softer demand is a silver lining, as it's allowing companies to reduce their backlogs, and is start to limit inflation.

...Firms highlighted the pass-through of higher costs to their clients as a driving factor behind greater output charges. A number of firms stated that slower input cost inflation, greater competition and softer demand conditions led to some concessions being made to customers, however, helping to cool the pace of charge inflation to its slowest since March 2021.

A softer rise in hiring activity also stemmed from reduced pressure on capacity in July. Backlogs of work fell for the second month running and at the steepest rate since May 2020. Broadly unchanged levels of work-in-hand at manufacturing firms was accompanied by a solid decline inincomplete business at service providers as softer demand conditions allowed firms to catch up with work outstanding.

What that means is that even if we are in "recession", it's not under conditions that seem recessionary to many. Jobs keep being added and are still in demand, the amount of work available isn't changing all that much (because they're catching up on older orders), and workers are still getting paid at higher wages than this time last year (even if it generally hasn't kept up with inflation over the last year).

The real question to me is if any slowdown in the economy will be severe enough to cause significant cutbacks in everyday business or employment. We haven't had many inflation-driven slowdowns in recent years, and it's a different situation than a slowdown caused by an asset market meltdown and/or a Bubble popping that reveals the economy to have been running on nothing, which leads to significant layoffs that strain demand further.

I don't think this is us. At least not yet.

These reports are another reason why I hope the Fed backs off its aggressive posture of interest rate hikes after next week. There's increasing evidence that US consumers and businesses are rationally adjusting to higher prices by backing off a bit, which is getting the economy back towards balance and decreasing inflation by itself. More data needs to come in to give an idea whether we're merely slowing or outright receding, but a Fed overshoot would be the worst situation that would inflict economic pain for more people, and prolong what should be a relatively brief and comfortable moderation.

No comments:

Post a Comment